Overview:

● Having a disciplined investment strategy helps build generational wealth.

● The investment industry generates the idea that higher priced investments are justified by better results.

● This article will cover research that has shown this to not exactly be the case.

● High fees and complexity erode substantial value in portfolios, it’s best to be wise by paying for things that matter.

Compound Growth: “The Eighth Wonder of the World”

A disciplined investment strategy can be an essential tool in building generational wealth. After all, investment earnings compound, presenting one of the few instances in life where time becomes your friend. Albert Einstein went as far as to call this compound growth “the eighth wonder of the world”, but don’t just take his word for it!

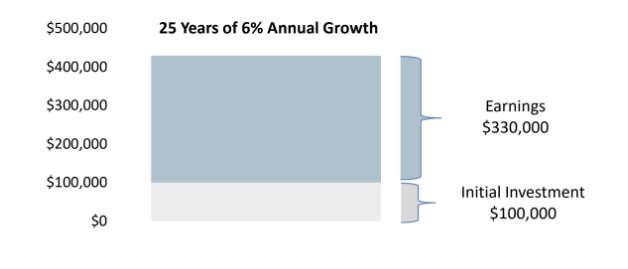

The following chart illustrates what happens to a $100,000 initial investment growing at a rate of 6% annually over 25 years. As you can see, an initial investment of $100,000 grows to $430,000 after the 25-year period; not bad!

Buyer Beware: High Investment Fees Can Restrict Growth

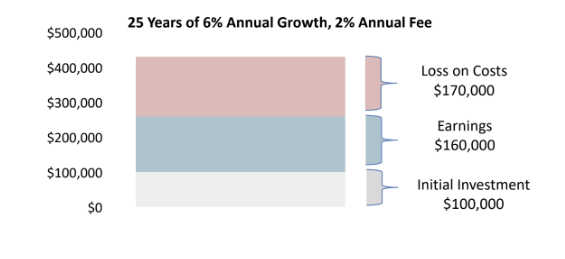

Given the upside of compound growth, many investment firms leverage the overcomplexity of the financial industry to justify high fees, commissions, and unneeded services. Like growth, these costs compound and can have an exponential impact.

The chart below illustrates the impact of a 2% annual fee added to our previous example. As you can see, fees eroded $170,000 in value over the 25-year period!

Higher Fees Do Not Equal Better Performance

Investment fee structures can be difficult to identify and complex, but generally come from a few key sources:

-

Management Fees:

How much is my manager charging me as a percentage of my assets each year?

-

Investment Product Fees:

What are the underlying costs of the investments in my portfolio?

-

Commissions:

Is my representative being paid a commission on the products/services recommended to me?

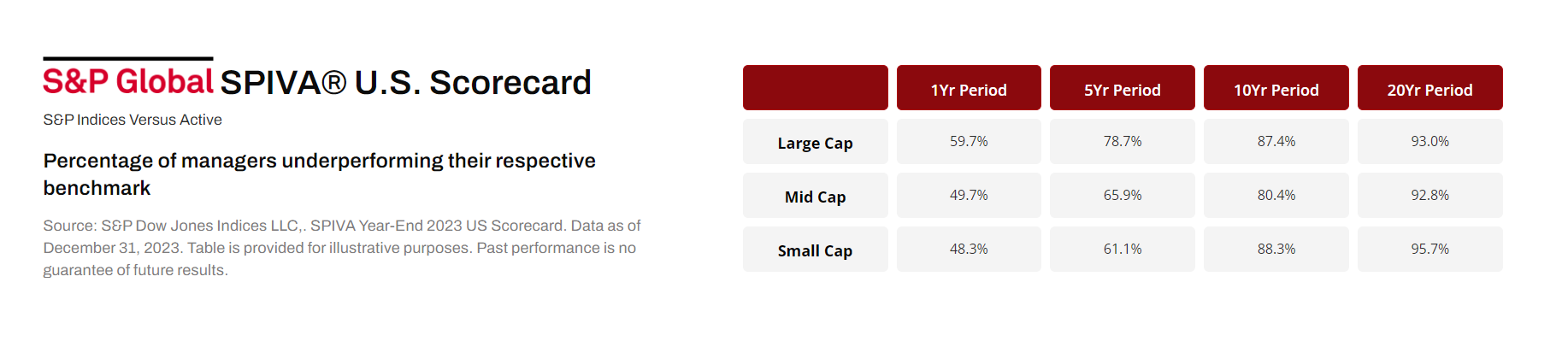

The investment industry – through its flashy use of advertising and acronyms, leads many to believe that high priced investment management is justified via better results. Research has shown the exact opposite to be the case.

Take for instance the data below from the 2023 S&P Versus Active Persistence Scorecard, which tracks the consistency of high-priced investment mutual funds vs their S&P benchmark. As shown in the table below sourced from a report by S&P, over a 20-year period, over 90% of U.S. equity managers underperform net of their underlying management fee.

Conclusion: Pay For Things That Matter

Altogether, high fees and overcomplexity can erode substantial value in portfolios across all shapes and sizes. When working with a professional, investors should avoid the false promises of high-cost management, market timing, and stock picking. Instead, investors should look for a simplified approach that focuses on great advice, planning, and service using thoughtful asset allocation and low-cost product selection.

As Einstein said, “if you can’t explain it simply, you don’t understand it well enough”.

BACK

BACK