This weekend my daughter and I headed out for an evening soccer game down in the DC metro area, it was Saturday night around 6pm. I found myself on Interstate 495 (Washington Beltway) approaching a slowdown and immediately looked to either side of me to see which lane I should move to next. I had somewhere to be and there had to be a decision I could make that would get me to my destination faster! After looking around and not seeing an opening my lane started moving again, then I had to slow. I stayed in my lane as it seemed like I was just going to be guessing if I moved to the right or left. While I drove, all lanes took their respective turns speeding up and slowing down, but we all really moved at the same pace at the end. Some just slightly quicker than others. About 15 minutes later traffic was flowing freely again. No doubt many of us have been in this situation before, sometimes guessing correctly, but often not.

Staying the Course

This everyday situation can be related to investing and our asset allocation strategy. There is no doubt that some asset classes outperform others in any short sample size, one month, one year, etc. but knowing which ones and when is nearly impossible to predict with any consistency. It’s important that we decide on a “route” or proper allocation spread across multiple asset classes and stay the course. If we can do this with discipline and focus we can achieve our investment goals and arrive at our desired destination without taking unnecessary risks like constantly changing investments – or driving lanes. Don’t let anxiety about missing the next best thing or hot idea derail your long-term investing goals.

Randomness of Returns

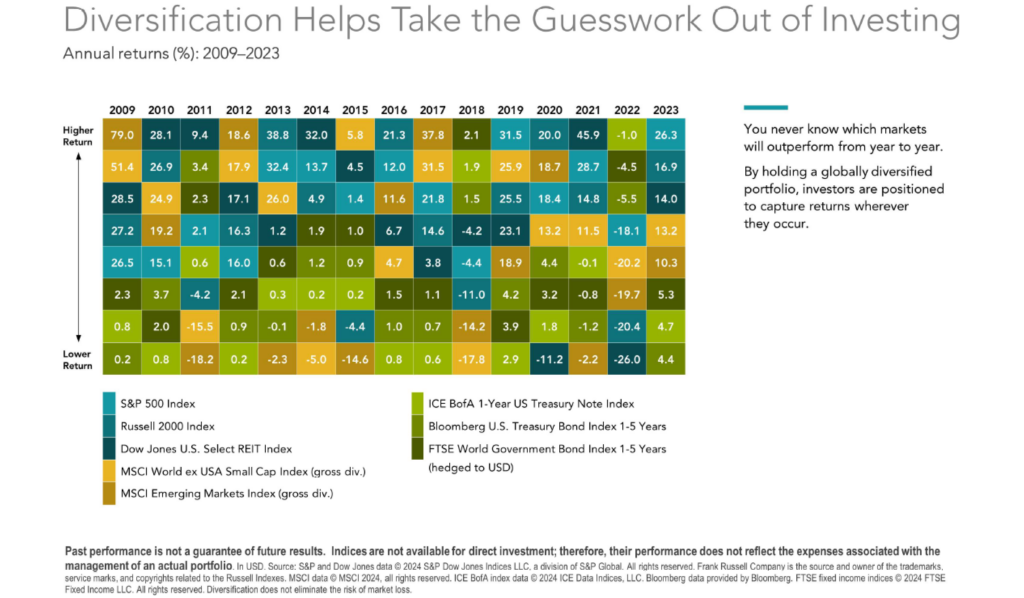

The chart below illustrates the randomness of returns during the period from 2009 through 2023. As you can see it is impossible to predict which asset class will be the “top performer” for any given year and it is extremely rare that a specific asset class is top of the chart or even near the top in a multiple consecutive year period. At Passive Capital Management (PCM) we take care to include all asset classes in our client’s portfolios in a broad-based allocation to assure that we are participating across the board and taking advantage of the returns the market gives us, no matter where they are. We are not going to predict the future, or ever attempt to. We are simply going to decide, based upon the goals and risk tolerance of each client, what the proper allocation looks like then implement it. Once the portfolio is in place our only “strategy” is to rebalance using discipline. We do not attempt to time the market or blindly choose which manager/product will produce results that we know will be produced by the broad capital markets over time.

Conclusion

At PCM we focus on controlling what we can control – costs, diversification, tax-efficiency, discipline and rebalancing. By doing this we avoid the mistake of thinking we can foresee or control the uncontrollable such as economic events and resulting market movement. The bad news is that PCM doesn’t have a crystal ball; the good news is that we don’t need a crystal ball in order to help each client enjoy a successful investment experience.

BACK

BACK